Letting in Camden.

Your local online letting experts.

Save £2,300 on average on your rental fees ex. vat.

5-star service. Quality tenants. Low fees. No renewal fees

Find out why we’re trusted by over 350,000 private landlords and renters, as well

as the UKs largest property funds.

Landlords Guide to Buy-to-Let in Belsize

Investing and letting in Belsize

As a potential landlord looking to invest in buy-to-let property in Belsize Park, it's important to understand the financial factors that can impact your investment. From average rents to rental yield and rental demand, each of these factors can influence your investment decisions. In this blog post, we'll delve into the key financial factors you need to consider before investing in Belsize Park.

Average Rents

Belsize Park is known for its high-end properties and affluent residents, which can reflect in the average rents. The average rent for a 1-bedroom flat in Belsize Park is around £1,650 per month, for a 2-bedroom flat it’s around £2,350 per month, and for a 3-bedroom flat it’s around £3,750 per month.

These figures are significantly higher than the London average, which can make it an attractive location for buy-to-let investors looking to maximise their rental income.

Rental Yield

One of the most important financial factors to consider when investing in buy-to-let property is the rental yield, which is the return on investment generated by the property. The average rental yield for a 1-bedroom property in Belsize Park is around 3.6%, for a 2-bedroom property in Belsize Park is around 3.2%, compared to the London average of 3.7%. For a 3-bedroom property, the average rental yield is around 3.3%, compared to the London average of 3.5%. While the rental yields in Belsize Park may be slightly below the London average, the high rental prices mean that buy-to-let investors can still generate strong rental income from their properties.

Rental Demand

Another important factor to consider when investing in buy-to-let property is rental demand, which can impact both the rental income and property values. Belsize Park is a highly desirable location with a high demand for rental properties, particularly among young professionals and families. The demand for rental properties in Belsize Park is 2.2 times higher than the London average, meaning buy-to-let investors can expect to receive a high level of interest in their properties and potentially secure higher rental incomes.

House Prices

House prices are also an important factor to consider when investing in buy-to-let property, as they can impact the overall return on investment. According to recent data, the average house price for a 1-bedroom property in Belsize Park is around £735,000, £1.3 million for a 2-bedroom property and £2.5 million for a 3-bedroom property. These figures being much higher than the London average can make it a challenging location for first-time investors with limited capital. However, for investors with a higher budget, Belsize Park can offer an attractive investment opportunity due to the potential for high rental incomes and strong capital growth.

Conclusion

In summary, investing in buy-to-let property in Belsize Park can be a smart financial decision due to the high rental prices and demand for rental properties in the area. While the rental yields may be slightly below the London average, the high rental prices mean that investors can still generate strong rental income. However, it's important to note that property prices in Belsize Park are significantly higher than the London average, which can make it a challenging location for first-time investors with limited capital. For investors with a higher budget, Belsize Park can offer an attractive investment opportunity due to the potential for strong capital growth in addition to high rental income, so it's important to do your research and consider all the financial factors that can impact your investment.

Belsize’s Housing Market and Transport Links

If you are a potential landlord looking to invest in a buy-to-let property, Belsize Park is a great location to consider. Situated in the heart of London, Belsize Park offers a range of residential properties, excellent transport links and a vibrant community. In this blog post, we will explore the housing market and transport links in Belsize Park to help you make an informed decision about investing in this area.

Residential Properties

Belsize Park offers a diverse range of residential properties, including flats, apartments and houses. There are approximately 4,500 residential properties in Belsize Park, with 1 bedroom flats being the most common property type. The breakdown of property types in Belsize Park is as follows:

1 bedroom flats - 50%

2 bedroom flats - 30%

3 bedroom flats and houses - 20%

It's important to consider the type and number of bedrooms when investing in a buy-to-let property, as this will affect the rental value and demand for the property. Belsize Park's property mix is slightly different from the London average, which has a higher proportion of 2 and 3 bedroom properties.

Housing Stock

In terms of housing stock, approximately 60% of residential properties in Belsize Park are owner-occupied, while the remaining 40% are rented. This is slightly lower than the London average, which has a higher proportion of rented properties. It's important to consider the renting vs occupier rate when investing in a buy-to-let property, as this will affect the demand and rental income potential.

Average House Prices

House prices are also an important factor to consider when investing in buy-to-let property, as they can impact the overall return on investment. According to recent data, the average house price for a 1-bedroom property in Belsize Park is around £735,000, £1.3 million for a 2-bedroom property and £2.5 million for a 3-bedroom property. These figures being much higher than the London average can make it a challenging location for first-time investors with limited capital. However, for investors with a higher budget, Belsize Park can offer an attractive investment opportunity due to the potential for high rental incomes and strong capital growth.

Age of the Housing Stock

Belsize Park has a mix of old and new housing stock, with some properties dating back to the early 1800s. Approximately 10% of the housing stock in Belsize Park is new build, which is lower than the London average. When choosing a buy-to-let location, it's important to consider the age of the housing stock as it can affect the maintenance and repair costs.

Transport Links

Belsize Park is well connected by train and bus links, making it easy for residents to commute to other areas of London. Belsize Park tube station is on the Northern line and is located in Zone 2. The station is serviced by six trains per hour in each direction, with journey times to central London taking approximately 15-20 minutes. In addition to Belsize Park station, residents can also use nearby stations such as Swiss Cottage and Chalk Farm.

Belsize Park is also well served by bus routes, with several buses stopping in the area. The bus links in Belsize Park are comparable to the London average, with frequent services to nearby areas and central London.

The commute times in Belsize Park are relatively short, thanks to its excellent transport links. Commuters can easily reach central London within 20 minutes via the Northern line from Belsize Park station. Additionally, there are several bus routes that provide quick and easy access to nearby areas such as Camden and Hampstead.

Conclusion

Investing in a buy-to-let property in Belsize Park is a wise decision for potential landlords. With its diverse range of residential properties, excellent transport links, and short commute times, Belsize Park is a highly desirable location for renters. The mix of owner-occupied and rented properties and the high average house prices also indicate a strong demand for rental properties in the area. When considering investing in Belsize Park, it's important to carefully consider the type and number of bedrooms, the renting vs occupier rate, the average house prices, the age of the housing stock, and the transport links to ensure a successful investment.

The Demographics of Belsize's Population

Belsize Park is a picturesque neighbourhood known for its tree-lined streets, green spaces, and stunning Victorian and Edwardian architecture. The area's history can be traced back to the 17th century when it was originally known as Manor of Belsize. In the late 19th century, the area was developed into a residential suburb, and since then, it has been a sought-after location for families, young professionals and students. In this article, we'll explore some key factors to consider when investing in a buy-to-let property in Belsize Park.

Population Size and Growth

Belsize Park has a population of around 13,000 people. Over the past decade, the population has grown by approximately 6%, which is in line with the average growth rate for London boroughs. However, what sets Belsize Park apart is its demographic makeup. The area has a higher proportion of young professionals and students compared to other areas of London. This is due to its proximity to universities and the City of London, as well as its vibrant cultural scene.

Age of Population

The age demographic of Belsize Park is quite diverse. While it has a higher proportion of young professionals and students, the area also attracts families and older residents. According to the 2011 census, 41% of the population were aged between 20-39 years, while 21% were aged 40-59 years, and 14% were aged 60 and above. This compares to the UK average of 31% of the population aged between 20-39 years, 31% aged 40-59 years, and 23% aged 60 and above. The diverse age range of the population is another factor that makes Belsize Park an attractive location for property investors.

Employment Rate

Belsize Park has a high employment rate, with 82% of the working-age population in employment. This is higher than the UK average of 75.5%. The area is well-connected to the City of London, which provides many employment opportunities for professionals. In addition, Belsize Park has a thriving small business community, with many independent shops, cafes, and restaurants, providing employment for local residents.

Education Level

Belsize Park has a highly educated population, with over 60% of residents having a degree-level qualification. This is much higher than the UK average of 38%. The area is home to several prestigious universities, including University College London, the University of London, and the London School of Economics. In addition, there are several high-performing schools in the area, making it an attractive location for families with children. The number of students in Belsize Park is around 5,000, making up approximately 40% of the population. This high concentration of students is another factor that makes Belsize Park an attractive location for property investors, as there is always a high demand for rental properties.

Crime Rate

Belsize Park has a relatively low crime rate compared to other areas of London. According to the latest crime statistics, there were 1,293 reported crimes in the area in the last 12 months. This is a crime rate of 100.5 per 1,000 population, which is lower than the average crime rate for London of 121.5 per 1,000 population. While no area is entirely crime-free, Belsize Park is generally considered a safe and secure location.

Conclusion

Investing in a buy-to-let property in Belsize Park is a wise decision due to the area's attractive demographic makeup. With a diverse population, high employment opportunities, and excellent educational institutions, the area is popular with young professionals, families, and students. The population growth rate is in line with the average for London boroughs, and the crime rate is relatively low compared to other areas of London. The high demand for rental properties in the area, particularly among the student population, makes Belsize Park an attractive location for property investors.

Important Links for Landlords and Letting a Property

- Council name: Camden Council, 020 7974 4444, customersupport@camden.gov.uk, https://www.camden.gov.uk/

- HMO licence contact: Private Sector Housing Team, 020 7974 4444, privatesectorhousing@camden.gov.uk, https://www.camden.gov.uk/houses-in-multiple-occupation

- Council tax website: https://www.camden.gov.uk/council-tax

- Civic amenities website: https://www.camden.gov.uk/civic-amenities

- Website for list of Belsize Park schools: https://www.camden.gov.uk/schools-directory

- Trading standards contact number: 03454 040506, trading.standards@camden.gov.uk, https://www.camden.gov.uk/trading-standards

- EPC register contact number: 0300 1234 121, enquiries@epcregister.com, https://www.epcregister.com/

- Waste collection contact number: 020 7974 2202, uk.occamden@veolia.com, https://www.camden.gov.uk/recycling-and-waste

- GSC register contact number: 0800 408 5500, info@gassaferegister.co.uk, https://www.gassaferegister.co.uk/

- List of postcodes in the area: NW3, NW6

Tenant find just £1200

Fully managed

Exceptional service

Landlords Guide to Buy-to-Let in Harrow

Investing and letting in Camden

Investing in buy-to-let property in Camden can be an interesting opportunity for potential landlords. However, there are several financial factors that should be taken into consideration before making a decision to invest. In this blog post, we will delve into the key financial factors that can impact the success of your investment in Camden.

Average Rents

The average rent for a 1 bedroom flat in Camden is currently around £1,500 per month, while a 2 bedroom flat can fetch around £2,200 per month. A 3 bedroom flat can have an average rent of £3,000 per month. These numbers are significantly higher than the average rents in the rest of London, which are around £1,500, £2,000 and £2,500 for 1, 2, and 3 bedroom flats, respectively.

Rental Yield

The rental yield is another important factor to consider when investing in buy-to-let property in Camden. The average rental yield for a 1 bedroom flat in Camden is around 4%, for a 2 bedroom flat it is around 3.5% and for a 3 bedroom flat, it is around 3%.While this is lower than the London average, the area still has interesting potential for investment due to high rental demand.

Rental Demand

With a growing population and a high demand for rental properties, the demand for rental properties in Camden is consistently on the rise. Currently, there is an average of around 3 tenants per property in Camden, higher than the average in London of 2 tenants per property.

House Prices

The average house prices in Camden are also important to consider when investing in buy-to-let property. The average price for a 1 bedroom house in Camden is around £600,000, for a 2 bedroom house it is around £800,000, and for a 3 bedroom house it is around £1 million. These prices are higher compared to the average house prices in London, which are around £500,000, £700,000, and £950,000 for 1, 2, and 3 bedroom houses, respectively.

In conclusion, with higher average rents and rental yields compared to the rest of London, and a growing rental demand, Camden has great potential for landlords. However, it’s important to also take into account the higher house prices in the area. By carefully considering these financial factors, you can make a well-informed decision and potentially reap the rewards of a successful investment in Camden.

Camden’s Housing Market and Transport Links

If you’re considering Camden as a potential location to invest, there are a few key things to keep in mind about the local housing market and transport links. In this article, we’ll take a closer look at the type and volume of residential properties in Camden, the balance between rental and owner-occupied housing, the average house prices, and the age of the housing stock. We’ll also cover the transport links in Camden and how they compare to the average in London.

Housing Stock

The housing market in Camden, London is thriving, with a variety of 1, 2 and 3 bed flats and houses available for purchase or rental. According to recent data, the volume of each type of property can be broken down as follows:

1 Bed Flats: In Camden, the volume of 1 bed flats has remained relatively stable over the past year, with approximately 2,500 units available on the market. This type of property is popular among young professionals, couples and retirees, and is often seen as a more affordable alternative to larger homes.

2 Bed Flats: The volume of 2 bed flats in Camden has been steadily increasing over the past few years, with over 4,000 units now available. This type of property is particularly sought after by families and individuals who require more space and is also popular among landlords looking for investment opportunities.

3 Bed Houses: The volume of 3 bed houses in Camden is relatively low compared to other types of properties, with only around 1,500 units available. This is due to the high demand for larger homes, which often results in a lower number of properties being available for purchase or rental.

It’s worth noting that the figures mentioned above are approximate and may vary depending on the specific location within Camden, as well as the time of year and market conditions. However, overall, Camden continues to be a popular and sought-after area for those looking for a home in the heart of London.

Rental vs Owner-Occupied

In terms of rental versus owner-occupied housing, Camden has a higher proportion of rental properties than the average for London. Around two-thirds of properties in the borough are rented, with the remaining third being owner-occupied. This is an important factor to consider when choosing a buy-to-let investment, as it will affect the demand for rental properties in the area.

Average House Prices

The average house prices in Camden are also important to consider when investing in buy-to-let property. The average price for a 1 bedroom house in Camden is around £600,000, for a 2 bedroom house it is around £800,000, and for a 3 bedroom house it is around £1 million. These prices are higher compared to the average house prices in London, which are around £500,000, £700,000, and £950,000 for 1, 2, and 3 bedroom houses, respectively.

Age of the Housing Stock

Camden has a mix of old and new properties, with a significant number of new build properties in the area. This is an important factor to consider when choosing a buy-to-let investment, as newer properties are often more attractive to renters and can command higher rental prices.

Transport

Camden has a number of train stations, including Camden Road, Kentish Town West, and Kentish Town, which provide easy access to central London. The borough is well served by the Northern Line, which runs from High Barnet to Morden via central London. The Overground line also runs through Camden, providing a quick and convenient route to destinations across London.

There are also a number of bus links in Camden, including several night bus routes. The bus links in the borough are extensive and provide easy access to central London and other parts of the city.

Commute times in Camden are relatively short, with easy access to central London. This is an important factor to consider when choosing a buy-to-let property, as it will affect the demand for rental properties in the area.

In conclusion, the housing market in Camden London is attractive with a variety of properties available for purchase or rental. The borough has a higher proportion of rental properties compared to the average in London and the average house prices are higher than the average in London. There is a mix of old and new properties in Camden, with new build properties being more attractive to renters. Camden also has a good transport network with train stations, bus links, and quick access to central London. These factors should be considered when choosing a buy-to-let investment in Camden.

The Demographics of Camden’s Population

Camden is one of the most vibrant and exciting boroughs in London. From its rich history as a centre of industry and transportation to its current status as a hub of culture and creativity, Camden has something to offer everyone. Whether you’re a local resident, a visitor, or an investor, you’ll find plenty to enjoy in this bustling corner of the capital.

Population

The population of Camden stands at approximately 246,000 people, making it one of the larger London boroughs. This population is growing, with the borough experiencing a steady increase in population in recent years. This growth is in line with the average for London as a whole, but it’s worth noting that Camden is more densely populated than the average London borough.

When it comes to the age of the population of Camden, it’s a relatively young borough compared to the UK average. The largest age group in Camden is those aged 25-34, with around 30% of the population falling into this category. This is a higher proportion than the average for the UK, and it’s a reflection of the vibrant and youthful culture that is found in Camden.

Employment rate

The employment rate in Camden is also strong, with a high proportion of the population in work. Around 74% of the population are in employment, which is above the average for the UK. This is due in part to the presence of a number of major employers in the area, including the British Library, the University College London, and a range of cultural institutions.

Education

Camden is one of the best-educated boroughs in the country. The level of educational attainment is high, with around 60% of the population holding a degree or equivalent. This is well above the average for the UK, and it’s a reflection of the strong tradition of academic excellence that is found in the borough. There are also a significant number in Camden due to its proximity to several universities and colleges in the city centre. This means that the student population is a key part of the local community, and it brings a youthful energy and vibrancy to the area.

Crime rate

It’s worth mentioning the crime rate in Camden. While it’s true that all areas of London have some level of crime, Camden is generally considered to be a safe place to live and work. The crime rate in the borough is below the average for London, and it’s a safe and secure place to call home.

In conclusion, the population of Camden is one of the key factors to consider when investing in a buy-to-let property here. With its young and educated population, strong employment rate, and vibrant student community, Camden is a dynamic and attractive place to live. Whether you’re looking for a place to call home, or an investment opportunity, Camden is an excellent choice.

Important Links for Landlords and Letting a Property

- Camden Council: 020 7974 4444, contact@camden.gov.uk, www.camden.gov.uk.

- HMO licence contact: 020 7974 4444, contact@camden.gov.uk, www.camden.gov.uk/hmo-licensing.

- Council tax: www.camden.gov.uk/counciltax.

- Civic amenities: www.camden.gov.uk/civic-amenities.

- List of Camden schools: www.camden.gov.uk/schools.

- Trading standards contact: 020 7974 4444, trading.standards@camden.gov.uk, www.camden.gov.uk/trading-standards.

- EPC register contact: 0300 003 1645, contact@epcregister.com, www.epcregister.com.

- Waste collection contact: 020 7974 4444, caw@camden.gov.uk, www.camden.gov.uk/wasteremoval.

- GSC register contact: 020 7974 4444, buildingcontrol@camden.gov.uk, www.camden.gov.uk/gsc.

- List of postcodes in Camden: NW1, NW3, NW5, NW6, NW8, W1, WC1, WC2, EC1, SW1, SW3, SW5, SW7 and SE1.

Save on average £2,300 on your Tenant Find fees with Home Made.

5-star service. Low fees. Find out why we're trusted by over 350,000 private landlords and renters, and the UKs largest professional landlords.

Free Landlord Resources

Free Instant Valuation

See how much your property could get in rent.

Fee Saving Calculator

See how much you could save on property fees.

Yield calculator

Calculate your rental yield with our simple tool

Compliance Guide

Download your complete landlord compliance guide

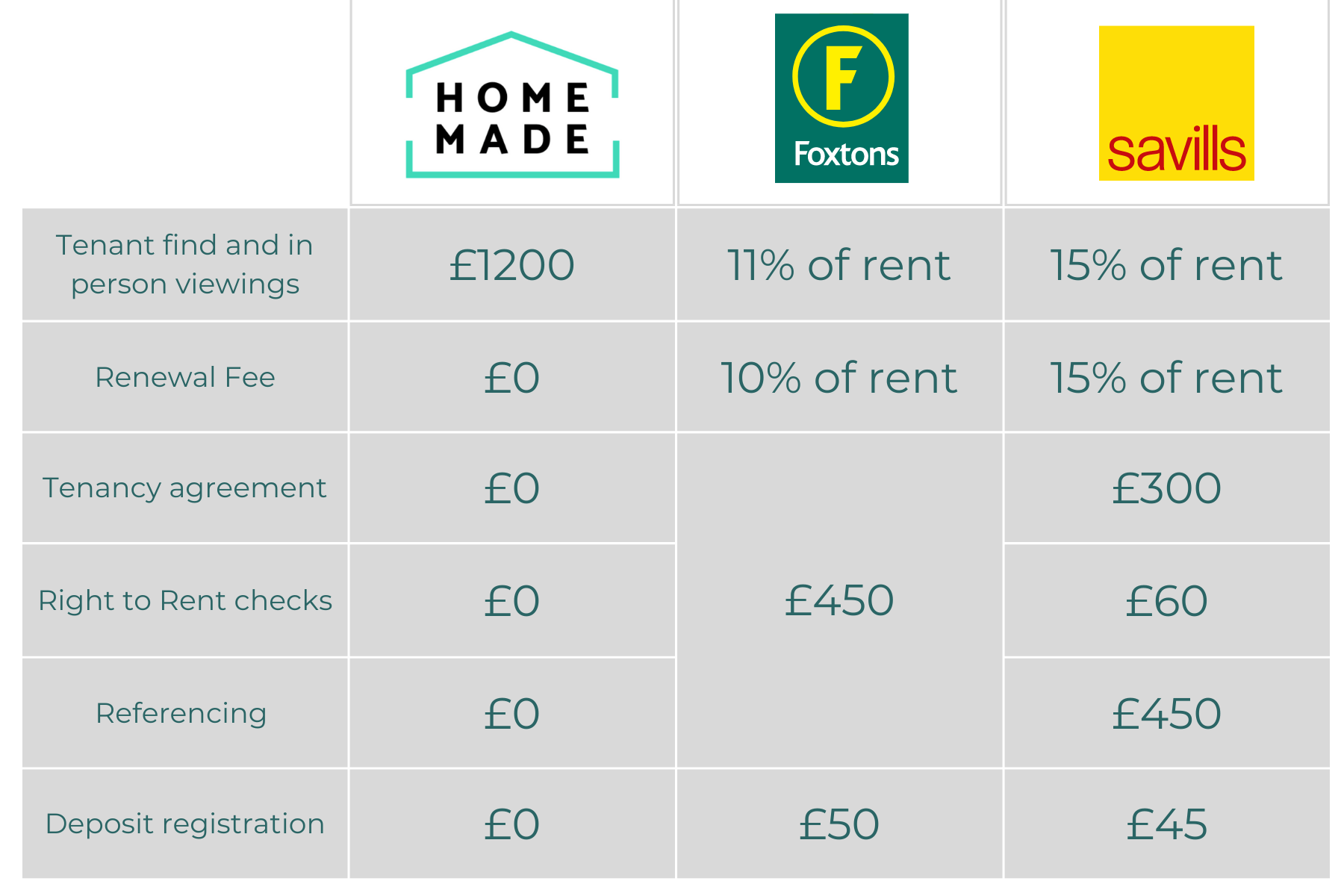

How our Fees Compare

When you compare our fees to traditional High Street agents’ fees in Camden you can see just how we can save you money:

- No renewal fees

- No hidden charges

- No charges for extras

Our unique operating model means we can offer full in-person Tenant Find service without the need for expensive High Street branches. And the savings we make are passed directly on to you.

Meet Sam your local Expert

Sam has a wealth of experience across the private landlord and Build to Rent sectors. He has advised a wide range of clients across the whole of London on how to find great tenants, improve their assets and effectively market their properties for the best returns.

Our Most Popular Articles

Finding the Right Tenant for your Buy-to-Let

Finding the right tenant is crucial for the success of your investment. Here our experts explore exactly how to go about it...

Read full article

How much Rent can a Landlord charge.

Setting the right level of rent is crucial. Here we explore what factors should go into making that decision...

Read full article

How to Calculate your Rental Yield

Maximising the return on your investment is essential. This article explores how to calculate your return, with top tips for increasing it.....

Read full article

Section 8 Notice - A Landlords Guide

If you, unfortunately, ever need to remove a tenant, it's key to understand how. Here we cover how to go about it legally...

See how much we save our landlords

We could save you

£5,040

On your tenant find fees over a two-year tenancy (ex. VAT).

That's Just

2.3%

of your rent over a two year tenancy (ex. VAT).

See how much our low flat fee and no renewal fees could save you

Figures based on £2,500 pcm rent, existing Tenant Find fees of 10% and renewal fees of 8%.

What our Customers Say

Thank you so much Angel

Angel is very thoughtful and helpful. She showed me around the flat and answered all my questions with patience. The process went smoothly with her assistance. without her help, I could not manage to find a flat to move into.

Excellent support and Service

John was a huge help in securing a new place in London after immigrating. We had a really tight turnaround time and very specific needs. He was fully appreciative of this and went out of his way to help us find a great fit.

Lola is amazing!

Lola has been so patient, kind and helpful; I cannot thank her enough. she assisted me with everything promptly and always responded to my emails and calls. Lola is truly the best!

Great customer service

Mo was very helpful and responsive when i asked questions regarding properties I was interested in. After providing criteria of the ideal property that I was looking to rent, Mo was quick to suggest options and then to arrange viewings.

Our Trusted Partners

As Featured on